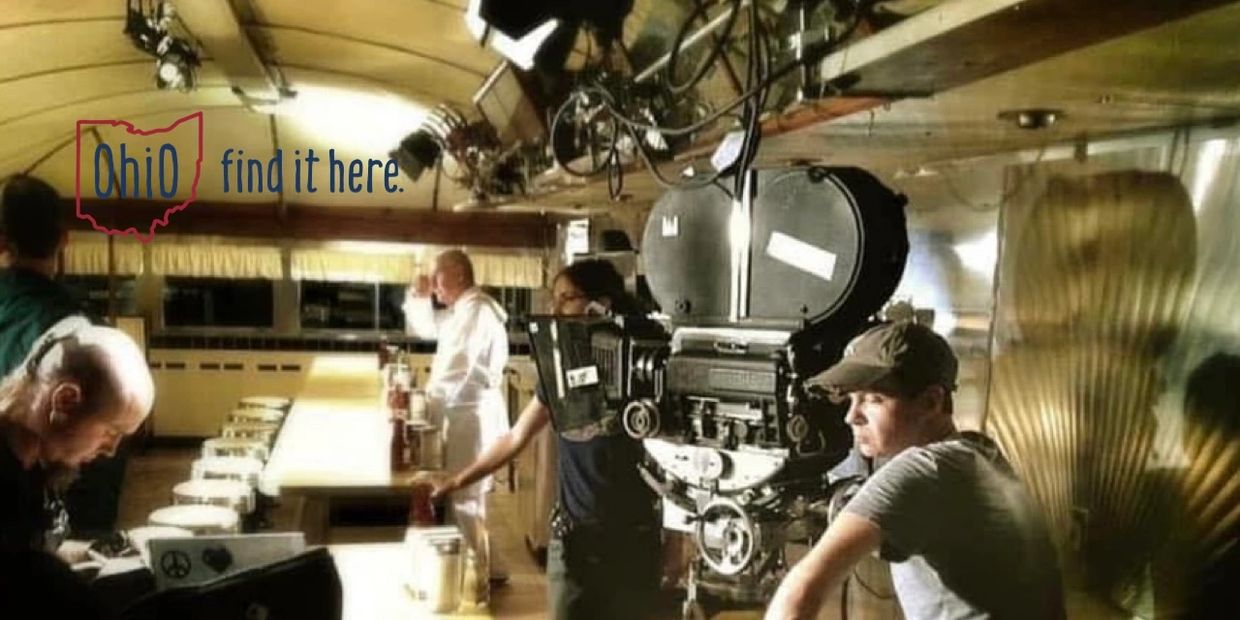

Why you Should Choose Ohio For Your PRODUCTION

Let Us Work for you!

Choose Ohio for your next Feature, short, or commercial production and We can help!

The Ohio Motion Picture Tax Credit provides a refundable tax credit of 30 percent on

production cast and crew wages plus other eligible in-state spending. The Ohio Motion

Picture Tax Credit was created in 2009 to encourage and develop a strong film industry in

Ohio. Find out More at: The Ohio Motion Picture Tax Credit provides a refundable tax credit of

30 percent on production cast and crew wages plus other eligible in-state spending. The Ohio

Motion Picture Tax Credit was created in 2009 to encourage and develop a strong film

industry in Ohio.

- Fee Change

To cover the administrative costs of the program, each applicant shall pay a non-refundable application fee of one percent of the award amount up to ten thousand (10,000) dollars. Failure to pay the fee will result in automatic rescission of the project’s tax credit award. - Carryover

If a project does not use all awarded tax credits, the remaining balance becomes available. In this way, tax credit availability may happen at any time. Tax credits not used in the prior fiscal year will rollover to the following fiscal year. - 50% Financing

Proof of financial ability to undertake and complete a motion picture must be included with the application. An applicant shall provide documentation showing that the company has secured funding equal to at least fifty percent of the total production budget. - Television Series or Miniseries

Once tax credits are available, the Ohio Film Office reviews applications to determine eligibility for the Ohio Motion Picture Tax Credit program. In approving tax credit applications, priority is given to tax-credit eligible productions that are classified as a television series or miniseries.

Ohio Department Of Development

Over 20 Years of Experience!

FILM OHIO BOARD MEMBERS ARE EXPERTS AT UNION PRODUCTIONS AND FOLLOW APPROVED LABOR AND SET SAFETY PRACTICES.

Reviews

Copyright © 2023 FilmOhio.org - All Rights Reserved.

Powered by GoDaddy